Static Rate Sheets in a Dynamic Freight Market

Every year, freight procurement resets the same way.

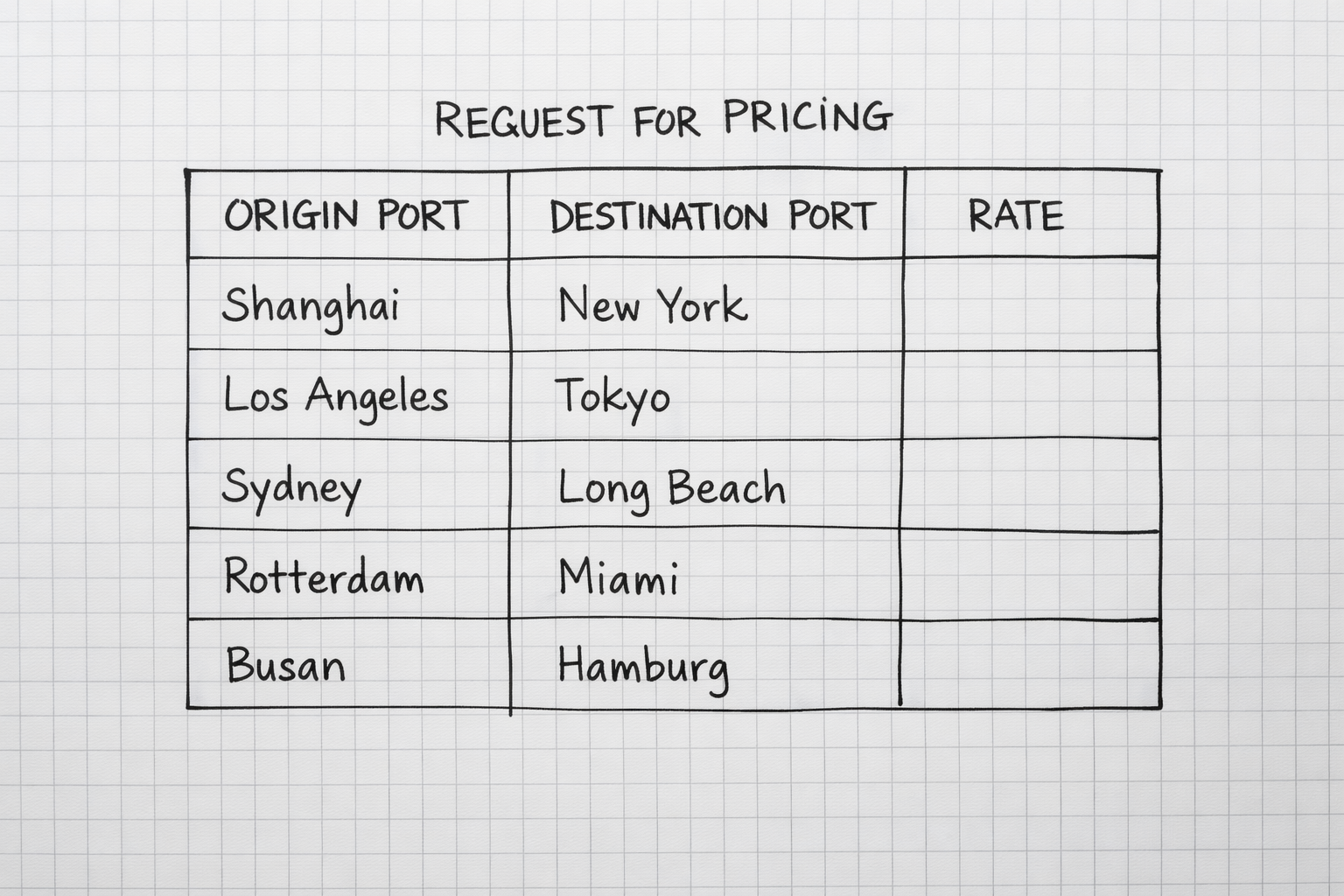

Shippers and NVOCCs review their lanes. Forecasts are refined based on how sourcing, demand, and inventory are expected to shift for the next 12 to 24 months. For each port pair and equipment size or type, everything the market might do over that period is compressed into a single rate cell for each carrier or NVOCC to fill in.

One number...

One cell in a spreadsheet...

Expected to govern for a year, sometimes two.

This cycle has defined freight procurement for decades, not because it is outdated, but because it has been the most practical way to impose order on a complex system. The challenge is that the system no longer behaves the way this process assumes.

What Procurement Teams Often Experience Next Is Familiar

Markets move, but contracts do not.

Service changes, but expectations remain fixed.

Costs drift, but the reference point stays the same.

By the time issues become visible, they are already embedded in execution and the conversation starts to sound familiar:

-

Why didn’t we see this coming?

-

Why does this keep happening?

-

Why does it feel like we are explaining the same variance every year?

This is not because teams are repeating mistakes. It is because the structure of the process freezes assumptions at negotiation while the market continues to evolve throughout the contract.

Where Static Rate Sheets Quietly Fall Short

Annual rate sheets are built to do one thing well: document agreed terms at the moment a contract is signed.

-

They provide clarity.

-

They create accountability.

-

They make large, distributed organizations operable.

What they do not do, and were never designed to do, is reflect how those agreements perform as conditions change over time.

Once contracts are in force:

-

Capacity allocation shifts by lane and trade

-

Service reliability changes by carrier and sailing

-

Assessorial exposure evolves quietly

-

Priority changes during peak periods, even when base rates do not

For NVOCCs, buy-side commitments and sell-side expectations begin to diverge as markets move underneath static terms. None of this shows up on a rate sheet, but all of it affects outcomes.

Why This Feels Like the Same Movie Every Year

The issue is not that rates were wrong at negotiation. It is that once the contract is signed, the primary reference point stops evolving even though the market does not. So volatility does not show up as a signal.

It shows up later as:

-

Missed sailings

-

Rolled cargo

-

Budget variance

-

Strained internal and external conversations

By the time those issues surface, teams are already deep into execution and the question becomes how to manage the impact, not how to adjust the assumptions. That is why so many freight cycles feel familiar, even when the market is not. Not because nothing has changed, but because the way change is detected has not.

This Is Not About Doing Procurement Better

Static rate sheets are not a failure of procurement discipline. They are the product of a system designed for stability. What has changed is the environment.

Volatility is no longer episodic. It is persistent.

And when volatility persists, static reference points stop being sufficient. Not because they are wrong, but because they are incomplete.

What This Leads To

Once contracts are signed, procurement teams still need situational awareness.

Not to renegotiate constantly.

Not to undermine carrier relationships.

But to understand when market conditions are diverging from the assumptions those contracts were built on.

In more mature markets, that awareness comes from trusted benchmarks. These are continuously updated references that provide a pulse on how conditions are evolving over time. Without that pulse, volatility does not disappear. It simply reappears later in execution, in budgets, and in the same conversations teams hoped not to repeat again this year.