Manage freight rate risk and increase opportunity.

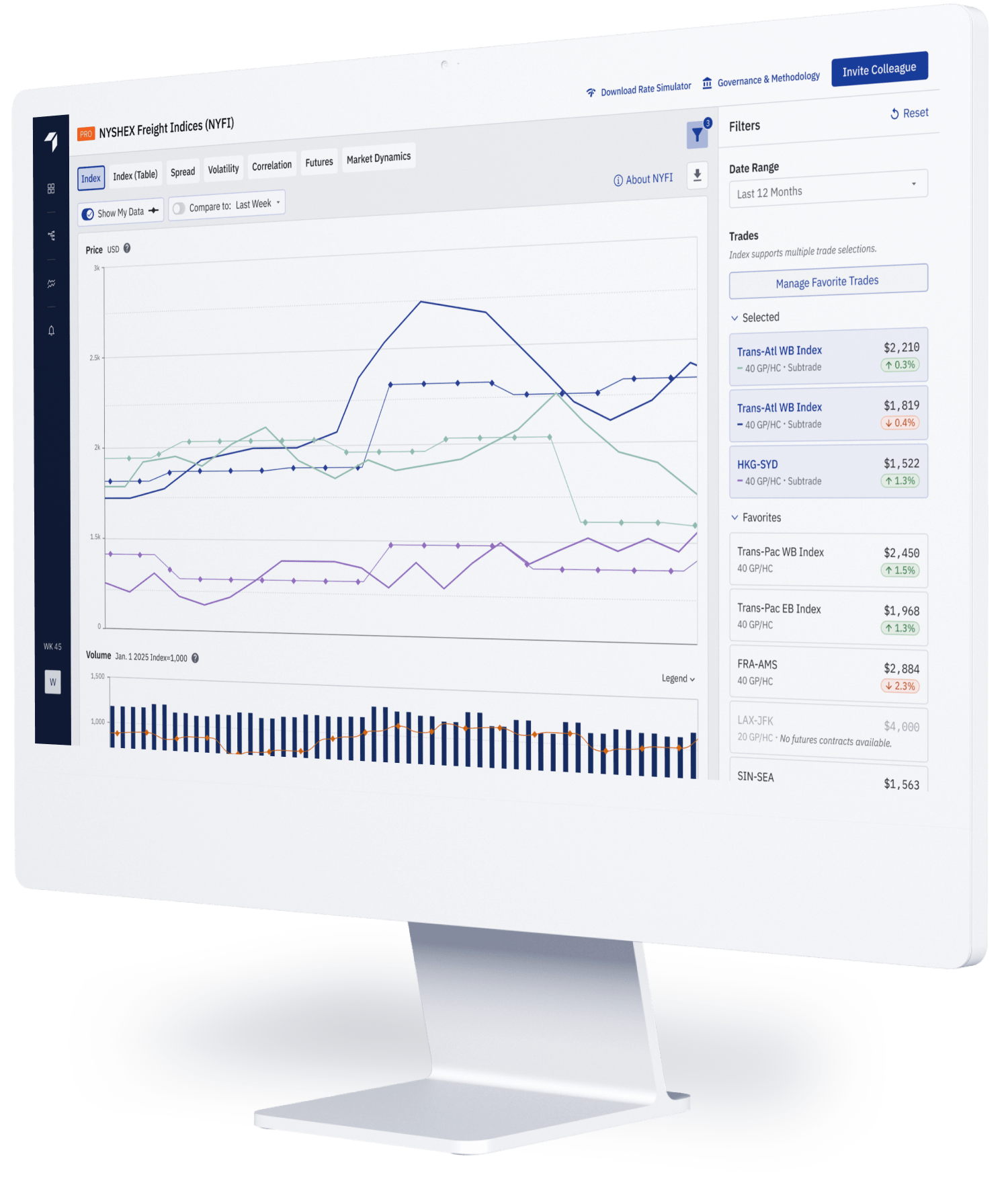

The NYSHEX Freight Index (NYFI) is built to global financial standards — auditable, neutral, and ready for index-linked contracts and futures.

Manage freight rate risk and increase opportunity.

The NYSHEX Freight Index (NYFI) is built to global financial standards — auditable, neutral, and ready for index-linked contracts and futures.

Check out the latest NYFI rates

NYFI Index Governing Board

Unified Platform

Created by the industry. Built for what's next.

The NYSHEX Freight Indices are global benchmarks for containerized freight pricing: a true industry utility that provides the foundation for risk management, understanding market movements, and building financial resilience across global shipping.

Part of NYSHEX’s mission to unite the shipping industry through transparency, performance, and shared standards, NYFI is governed equally across the industry by a board of shippers, carriers, and NVOCCs, resulting in the credibility of a financial benchmark with the collaboration of the shipping industry.

Incorporate NYFI into your risk management strategy via our platform or API access directly into yours.

Value Proposition

Freight intelligence, done right.

Instant Access

No onboarding. No demos. Completely free. Access weekly indices instantly and receive email updates for every new publication.

Transparent Governance

Every rule is published, every change approved — by a neutral board with equal votes from shippers, carriers, and NVOCCs.

Market-Wide Data

Collected from shippers, carriers, and NVOCCs — ensuring a complete, balanced view of real freight movements.

Global Coverage

Covering key trades now, with interregional and emerging lanes next on the horizon.

Powered by Real Shipments

Unlike other indices built on quotes, every data point is backed by invoices and bills of lading, revealing the true price paid to move cargo.

Built for Contracts & Futures

Designed for index-linked contracts and container freight futures, NYFI bridges the physical and financial markets — creating the foundation for disciplined freight risk management.

Use Cases

How NYFI helps you succeed.

Whether you’re a shipper, forwarder, or carrier, NYFI delivers the insights and tools you need to navigate volatile freight markets with confidence.

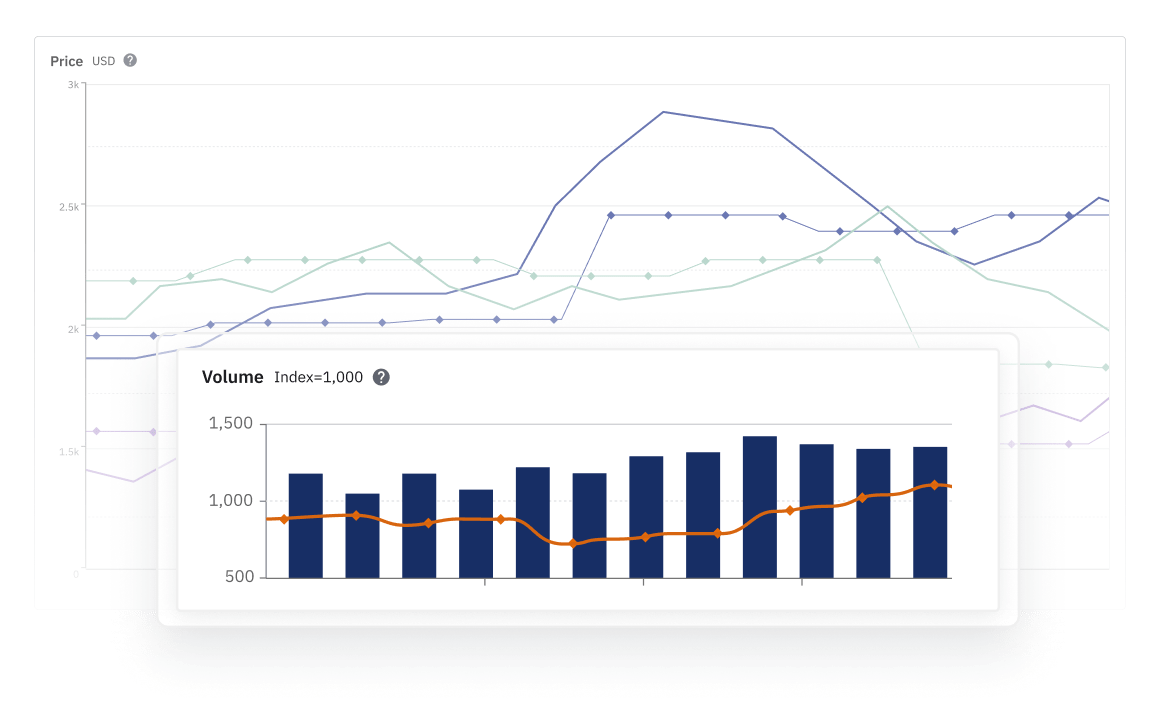

See real shipment rates — not just quoted prices.

Weekly transparency into real, loaded cargo gives shippers, carriers, and NVOCCs a shared truth to forecast, plan, and price with confidence.

→ Outcome: Clarity and alignment across every negotiation.

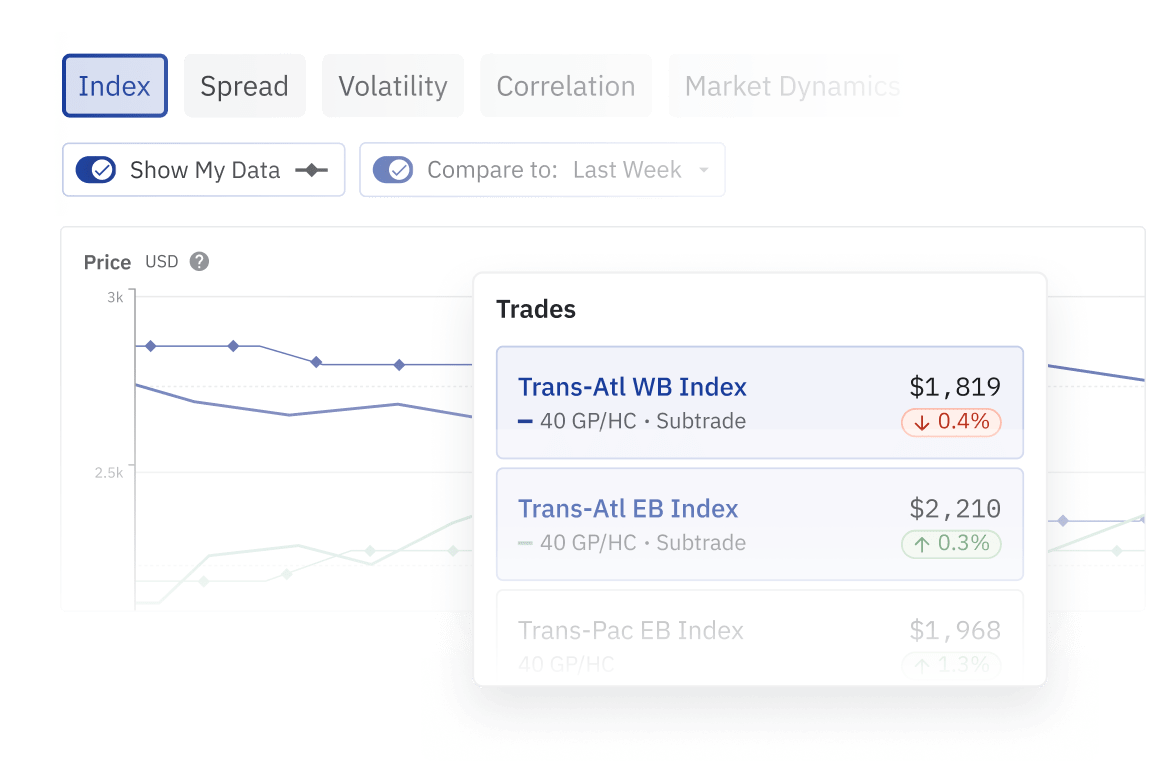

Contracts that hold, even when markets don’t.

Built for parity across shippers, carriers, NVOCCs, NYFI supports index-linked contracts grounded in auditable, board-governed data.

→ Outcome: Predictable performance through volatility.

Turn freight volatility into a financial strategy.

A single, neutral reference point for global freight.

Benchmark quotes, yields, or customer rates against the only index built on actual shipments — not intent.

→ Outcome: Trusted data that ends rate disputes before they start.

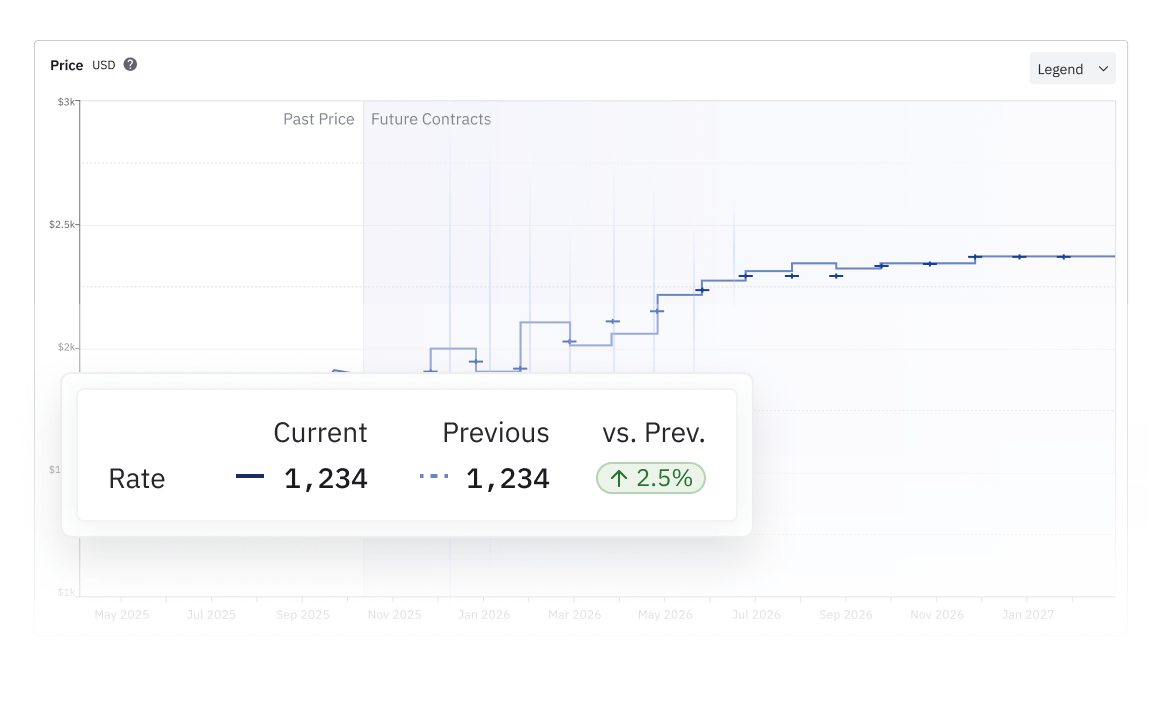

Use futures prices to understand what the market expects.

Leverage NYFI-linked futures prices to reveal market expectations and manage exposure to rate swings — and, soon, trade container freight futures.

→ Outcome: Freight becomes manageable, not unpredictable.

NYFI Methodology

Transparent. Credible. Governed.

NYFI is built with a transparent methodology, published standards, and oversight by an independent board ensuring every rate can be trusted for index-linked contracts, benchmarks, and futures.

Publication

Weekly for previous ISO week.

Friday 10:00 US Eastern TimeData Providers

Shippers, Carriers, and NVOCCs.

Only shipments loaded on board during the ISO week prior to index publication are included.Containers

20' Std, 40' Std, 40' HC.

Rates for 40' combine 40' Std + 40' HCTrade Specifics

Trans-Pac EB - Asia → USWC

Trans-Pac EB – Asia → USEC

Trans-Atlantic WB - Europe → USEC

Trans-Atlantic EB - USEC → Europe

Asia WB – Asia → North Europe

Volume Weighted Avg. (VWA)

70% carrier / 30% NVOCC.

70% carrier / 30% NVOCC.

50% carrier / 50% NVOCC.

50% carrier / 50% NVOCC.

70% carrier / 30% NVOCC.

Sub-trade VWA

- China/Taiwan → USWC – 60%

- SE Asia → USWC – 25%

- NE Asia → USWC – 15%.

- China/Taiwan → USEC – 45%

- SE Asia → USEC – 39%

- NE Asia → USEC – 16%.

- North Europe to USEC

41%. - North Europe to USGC

8%. - North Europe to USWC

9%. - Mediterranean to USEC

32%. - Mediterranean to USGC

8%. - Mediterranean to USWC

2%.

- USEC to North Europe

44%. - USGC to North Europe

14%. - USWC to North Europe

14%. - USEC to Mediterranean

20%. - USGC to Mediterranean

8%.

-

China/Taiwan → North Europe 60%.

-

SE Asia → North Europe 20%.

- NE Asia → North Europe 20%.

FMC Regulated

Yes

Yes

Yes

Yes

No

Rate Composition

-

Includes base ocean freight and all mandatory surcharges (bunker, CAF, PSS, war risk, port congestion, canal transit).

-

Excludes all landside surcharges (port fees, customs, inland on-carriage).

-

Origin THC excluded, destination THC included.

-

Includes base ocean freight and all mandatory surcharges (bunker, CAF, PSS, war risk, port congestion, canal transit).

- Excludes all landside surcharges (port fees, customs, inland on-carriage).

- Origin THC excluded, destination THC included.

- Includes base ocean freight and all mandatory surcharges (bunker, CAF, PSS, war risk, port congestion, canal transit).

- Excludes all landside surcharges (port fees, customs, inland on-carriage).

- Origin THC excluded, destination THC included.

- Includes base ocean freight and mandatory surcharges.

- Excludes all landside surcharges (port fees, customs, inland on-carriage).

- Origin THC included, destination THC excluded.

- Includes base ocean freight and all mandatory surcharges (bunker, CAF, PSS, war risk, port congestion, canal transit).

- Excludes all landside surcharges (port fees, customs, inland on-carriage).

Data Integrity

Data you can trust.

A freight index is only as strong as its data. NYFI captures actual shipped transactions not quotes, tenders, or estimates.

Every data point is validated for completeness, timing, and accuracy, ensuring the benchmark reflects true market behavior week after week.

The result: reliable benchmarks upon which you can anchor budgets, contracts, and futures, avoiding surprises.

Industry Governed

Equal representation for shippers, carriers, and NVOCCs via a multi-stakeholder council.

Trusted at Scale

2,000+ weekly active users across the global container community.

Robust Compliance

Operates under Federal Maritime Commission (FMC) agreement.

Reality Check

NYFI vs other indices.

A freight index is only as strong as its data. NYFI captures actual shipped transactions — not quotes, tenders, or estimates — and applies consistent weighting across verified trade lanes.

Attribute

NYFI

Other Indices

Data Source

Actual shipped container invoices and B/L data

Quoted and negotiated rates (many never shipped)

Governance

Governed by an independent board with equal representation from shippers, carriers, and NVOCCs.

Privately owned company — no multi-party governance

Auditing

Independently reviewed for data integrity and methodological accuracy aligning with financial-benchmark best practices.

Operate without multi-party oversight or industry representation in their review process.

Transparency

Full methodology and weighting published, board-approved changes only

Methodologies are publicly disclosed for compliance, but updates are determined internally by the index owner without external governance or industry representation.

Access

100% free utility, no onboarding, no sales calls, no paywall

Paid SaaS subscription required, access tied to demo or sales engagement

Testimonials

What the industry is saying about NYFI.

“Reliable freight indices are no longer optional, they’re essential. The ability to base contracts and risk management on shipped, auditable data is what will finally bring stability to ocean freight markets. What NYSHEX is doing with NYFI and futures is the missing link between supply chain strategy and financial discipline.”

Lars Jensen

CEO

“I’m looking forward to the Freight Futures Forum as a key opportunity for the industry to exchange ideas and strengthen its approach to managing volatility. As an innovative global logistics solutions provider, KWE is committed to staying ahead of emerging developments and industry trends to remain a trusted partner to our clients. Engaging with experts and peers at this event will be invaluable in enhancing our collective understanding of risk management and supporting customers as this new area of the market evolves.”

Steven Moser

VP Ocean

“As an agri shipper, we hedge the risk that the price of our goods changes between the time we agree to a sale and the time we deliver. However, we are exposed to the risk that the price of shipping our goods can change significantly between the time of sale and time of delivery. I’m excited to be speaking at the NYSHEX and ICE Futures Forum in London, where we will work together with other industry leaders on a way to hedge our shipping price exposure.”

April Zobel

Profit Center Manager

“We’re excited to be part of this discussion at such a pivotal time for the industry. As futures trading begins to take shape in this market, it’s vital to share knowledge, promote transparency, and help participants understand how effective risk management tools can support sustainable growth and confidence.”

Raphaël C. Amiach

Director of Commodity Sales Europe

“With volatility in global trade at an all-time high, conversations around container futures trading and hedging have never been more relevant. It’s a great opportunity to share insights, learn from peers, and explore solutions that will shape the future of global shipping.”

Peter Stallion

Container FFAs/Freight Futures, Clarksons

Insights

Latest NYFI insights.

From Rates to Signals: How Leading Teams Read the Freight Market

For decades, freight rates have been treated as answers.

Read MoreStatic Rate Sheets in a Dynamic Freight Market

Every year, freight procurement resets the same way. Shippers and NVOCCs review their lanes. Forecasts are refined based on how sourcing, demand, and inventory are expected to shift for the next 12 to 24 months. For each port pair and equipment size ...

Read MorePlans ≠ Outcomes: Why Freight Budgets Fail After the Contract Is Signed

Execution is where freight problems surface. It’s where teams firefight bookings, manage rollovers, chase capacity, and explain why costs and service didn’t line up with plan. That’s why execution gets the blame when freight budgets miss.

Read MoreThe industry’s building something better—don’t just watch it happen.

Be part of the first wave to receive real market insights built by and for the ocean freight community. Let’s move forward, together.

Frequently Asked Questions

What makes NYFI different from other freight indices?

NYFI is the only freight index built entirely on shipped transactions — not quotes, tenders, or modeled data. Other indices reflect rate intent; NYFI reflects market reality. It’s trusted for commercial contracts, benchmarking, and risk management — not just trend analysis.

How does NYFI collect and validate shipment data?

NYFI sources anonymized, executed shipment data directly from global shippers, carriers, and NVOCCs. Each record is validated for accuracy and completeness, while outliers are automatically flagged and reviewed under NYFI’s published methodology — ensuring only verified, representative data shapes the index.

How often are NYFI indices updated?

Published weekly to balance timeliness with stability, NYFI reflects the actual rates of cargo that moved during that period — providing current visibility without distortion.

How is NYFI governed and audited?

NYFI operates under a neutral governance model — no single company controls the data, methodology, or publication. All changes must be approved by a board equally representing shippers, carriers, and NVOCCs. NYFI meets the integrity, transparency, and oversight standards of regulated financial benchmarks.

Can NYFI be used for index-linked contracts or futures?

Yes. NYFI was designed to serve as the foundation for index-linked contracts and container freight futures. Its governance, methodology, and validation standards ensure that both commercial and financial stakeholders can rely on it with confidence.

Why does NYFI use only shipped data and not quotes?

Quotes reflect intent, not execution. In volatile markets, that difference can distort reality. NYFI’s shipped data ensures every rate represents a transaction that actually occurred — not what someone hoped to pay or charge.

Which surcharges are included in NYFI indices?

NYFI includes consistent, mandatory surcharges such as Bunker Adjustment, Security, and Terminal Handling Charges, while excluding variable or temporary costs like Peak Season or Congestion. This balance ensures clean comparability and eliminates distortion from one-off conditions.