NYFI PRO

Turn freight data into strategy.

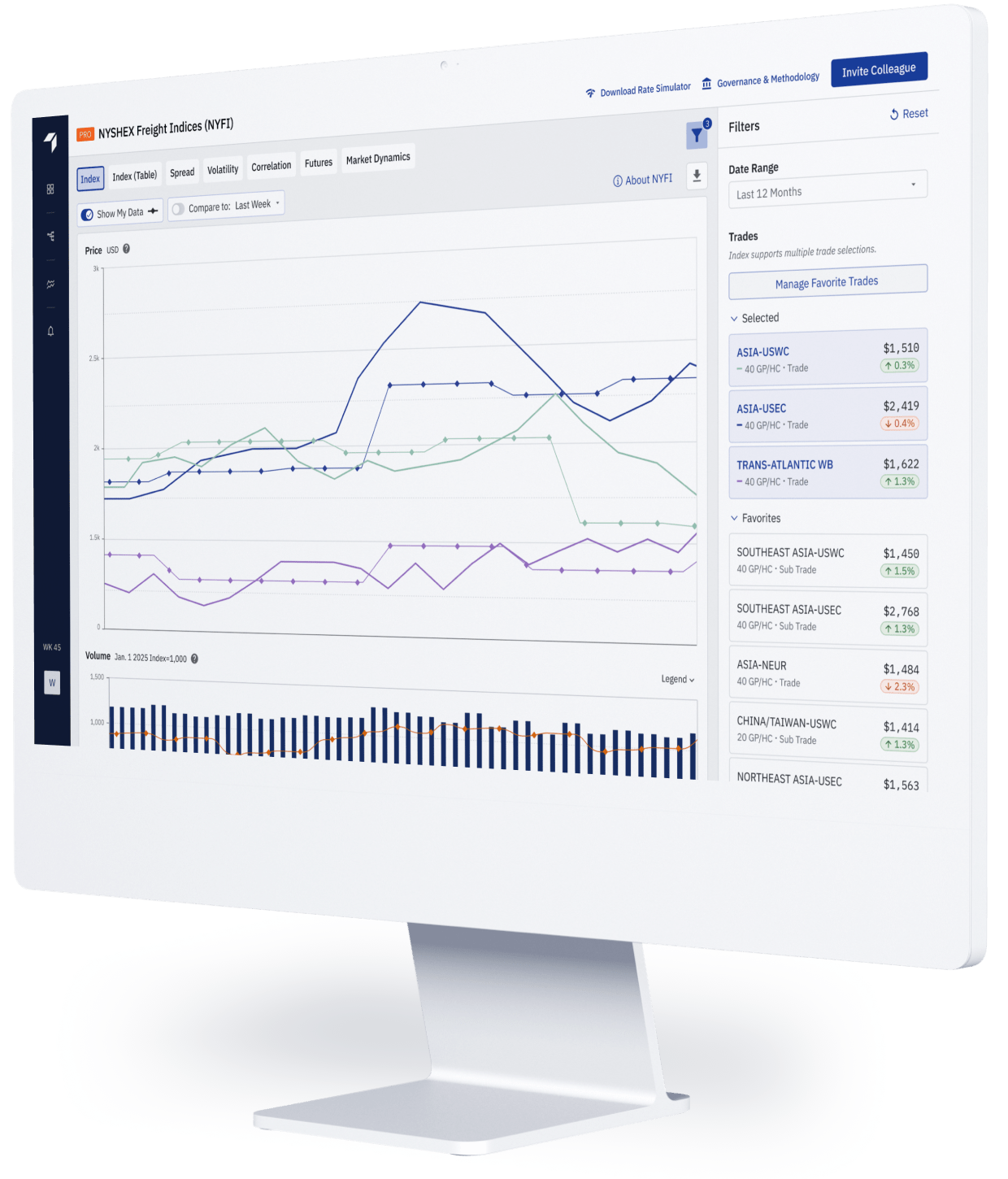

Unlock the full power of NYFI with NYFI PRO: deeper data, advanced analytics, and benchmarking tools that help you see the market clearly, manage risk with confidence, and forecast with precision.

From Insight to Foresight

See NYFI PRO in action.

With NYFI PRO, you move from observing the market to operating with it. Analyze volatility, track rate spreads, benchmark your own performance, and connect real-time NYFI data directly into your internal systems.

Turn rate visibility into negotiation power and make smarter, faster freight decisions with data built for performance.

Anticipate Tomorrow’s Market

Why upgrade to NYFI PRO.

NYFI PRO gives you the power to integrate deeper analysis, forecasting, and benchmarking into your daily workflow so you can make faster, smarter freight and finance decisions.

Free

Get started with NYSHEX indices data and tools at no cost.

PRO

Best for analysts, carriers, shippers, & NVOs tracking trends and deep insights.

Data Granularity

Container Type

40’ GP

20' GP, 40' GP/HC

History

24-month rolling

Unlimited access from 2023 onward

Trade

Trade & sub-trade

Trade & sub-trade

Volume

No

Market Volume

Advanced Insights

Futures

Futures curve

Compare to previous periods to view how the futures curve is evolving

Technical Analyses

No

High & low rate spreads, volatility & correlation

Benchmarking

No

Compare your rates & your volume to the market.

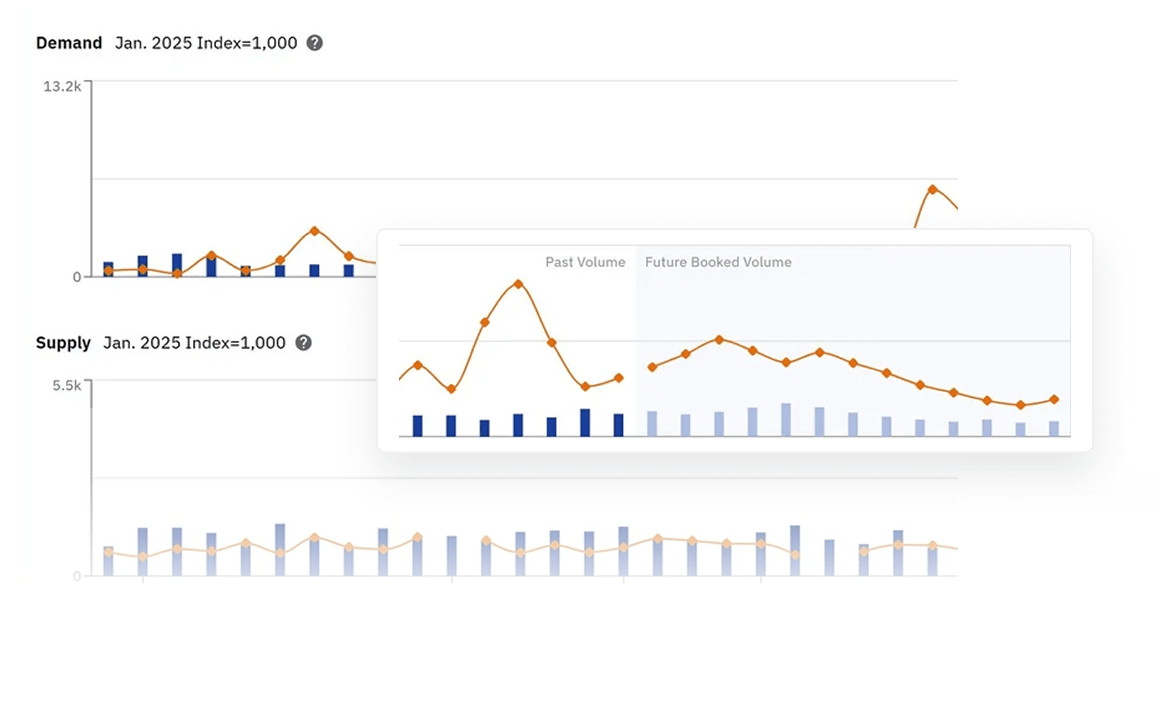

Supply and Demand

No

Market volume & futures booking curve, market capacity & blank sailings, adjusted future capacity view.

Data Access

Platform Access

Yes

Yes

Schedule Planner

Yes

Yes

Notifications

Yes

Yes

Access NYFI PRO.

NYFI PRO gives you the power to integrate deeper analysis, forecasting, and benchmarking into your daily workflow so you can make faster, smarter freight and finance decisions.

Become a NYFI Data Provider

Join the network of shippers, carriers, and NVOCCs who contribute anonymized rate data securely through our governed platform and get NYFI PRO access at no cost.

Use Cases

How NYFI PRO helps you succeed.

Whether you’re a shipper, carrier, or NVOCC, NYFI delivers the insights and tools you need to navigate volatile freight markets with confidence.

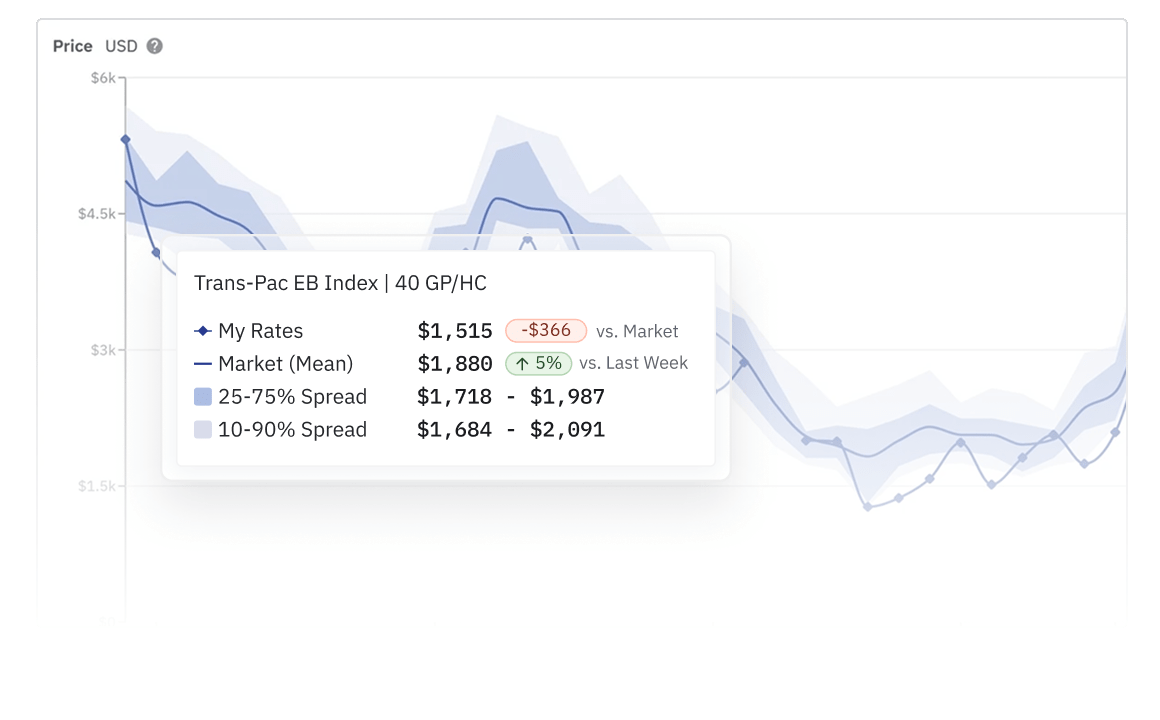

See exactly where you stand.

Upload your data securely to benchmark your rates and your volume against NYFI market data.

→ Outcome: Quantify competitiveness, uncover savings, and prove performance internally.

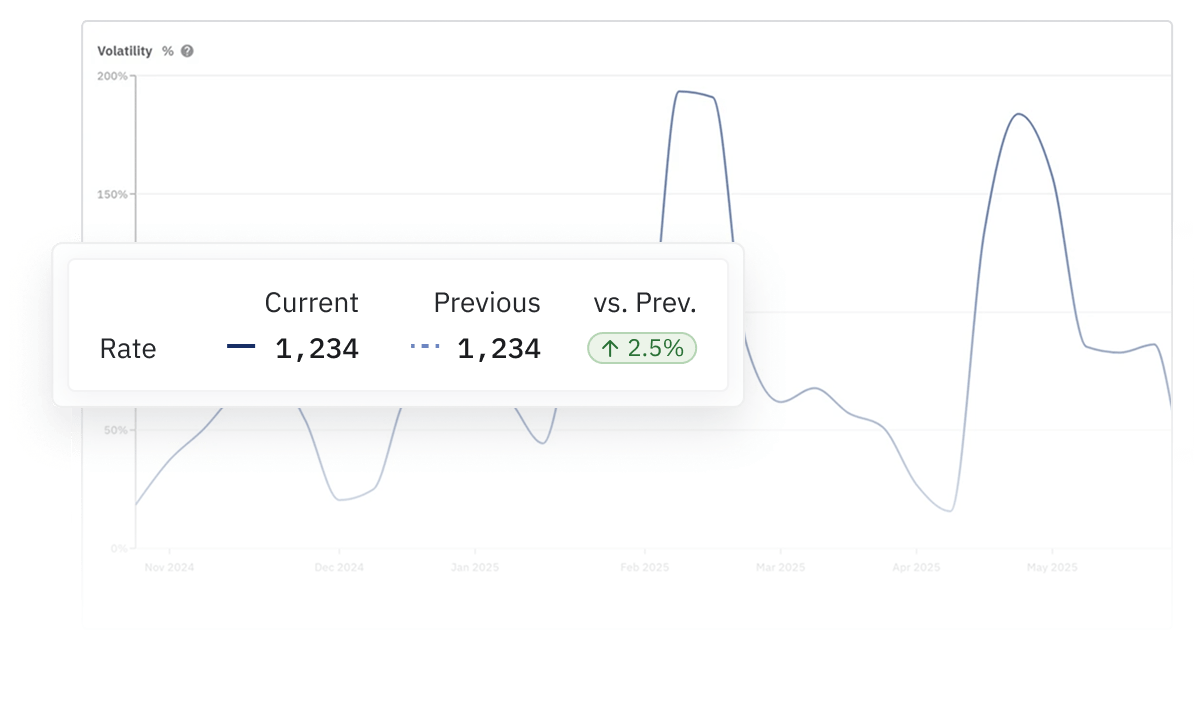

Turn market movement into strategy.

Identify volatility, correlations, and rate spreads across lanes to know when to fix rates or ride the market.

→ Outcome: Spot emerging trends, time contracts effectively, and make data-driven rate decisions before the market shifts.

Anticipate pressure points.

View the relationship between future market bookings, expected vessel capacity, and forward prices — all in one screen.

→ Outcome: Align procurement and capacity planning with the real balance of bookings, supply, and pricing.

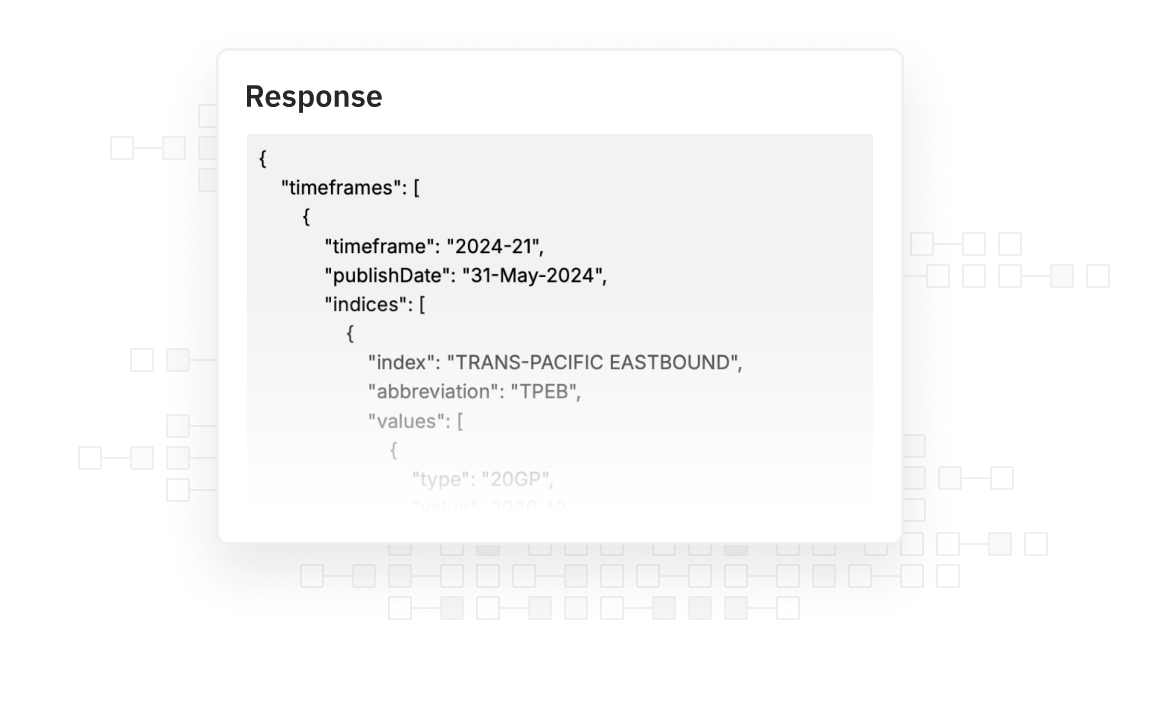

Bring NYFI insights into your own workflow.

Integrate NYFI data directly into your internal systems for custom analysis and automated reporting.

→ Outcome: Power your dashboards and models with one trusted data source.

About NYFI

The freight index created and trusted by the industry.

Industry Governed

Equal representation for shippers, carriers, and NVOCCs via a multi-stakeholder council.

Trusted at Scale

2,000+ weekly active users across the global container community.

Robust Compliance

Operates under Federal Maritime Commission (FMC) agreement.

Testimonials

What people are saying about NYSHEX.

“Reliable freight indices are no longer optional, they’re essential. The ability to base contracts and risk management on shipped, auditable data is what will finally bring stability to ocean freight markets. What NYSHEX is doing with NYFI and futures is the missing link between supply chain strategy and financial discipline.”

Lars Jensen

CEO

“I’m looking forward to the Freight Futures Forum as a key opportunity for the industry to exchange ideas and strengthen its approach to managing volatility. As an innovative global logistics solutions provider, KWE is committed to staying ahead of emerging developments and industry trends to remain a trusted partner to our clients. Engaging with experts and peers at this event will be invaluable in enhancing our collective understanding of risk management and supporting customers as this new area of the market evolves.”

Steven Moser

VP Ocean

“As an agri shipper, we hedge the risk that the price of our goods changes between the time we agree to a sale and the time we deliver. However, we are exposed to the risk that the price of shipping our goods can change significantly between the time of sale and time of delivery. I’m excited to be speaking at the NYSHEX and ICE Futures Forum in London, where we will work together with other industry leaders on a way to hedge our shipping price exposure.”

April Zobel

Profit Center Manager

“We’re excited to be part of this discussion at such a pivotal time for the industry. As futures trading begins to take shape in this market, it’s vital to share knowledge, promote transparency, and help participants understand how effective risk management tools can support sustainable growth and confidence.”

Raphaël C. Amiach

Director of Commodity Sales Europe

“With volatility in global trade at an all-time high, conversations around container futures trading and hedging have never been more relevant. It’s a great opportunity to share insights, learn from peers, and explore solutions that will shape the future of global shipping.”

Peter Stallion

Container FFAs/Freight Futures, Clarksons

Master volatility. Maximize opportunity.

NYFI PRO gives you the power to integrate deeper analysis, forecasting, and benchmarking into your daily workflow so you can make faster, smarter freight and finance decisions.